DFI Capital is a venture capital fund dedicated to driving growth in technology-driven companies, with a focus on forex trading algorithms and financial innovation.

DFI Capital is a venture capital firm investing in technology companies within financial markets. We support innovative businesses in creating advanced trading software, driving growth in the financial sector.

Team members

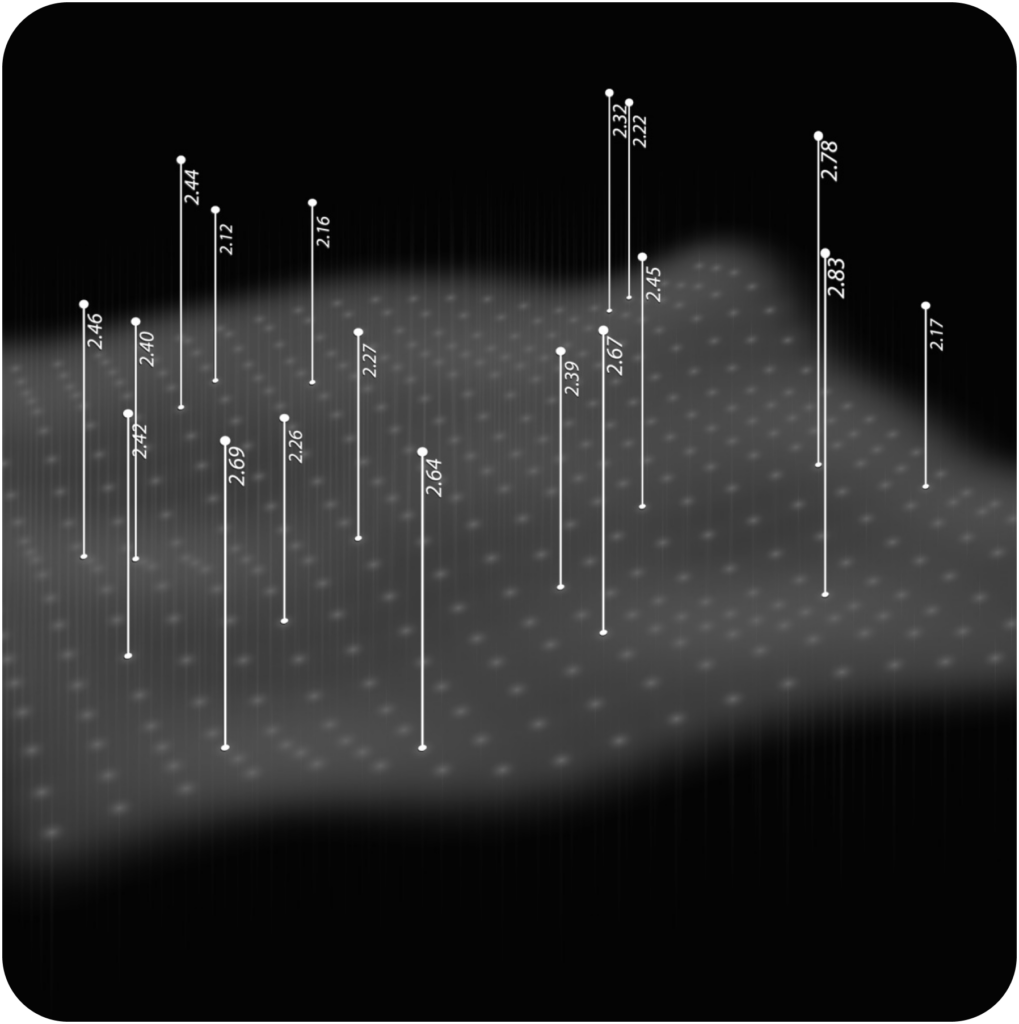

Years of experience

Total ROI

Last month’s ROI

Our strategy focuses on identifying and supporting privately owned companies that excel in algorithmic trading and financial technology.

RBF provides companies with the resources they need to grow while offering regular payouts to investors, ensuring a strong alignment of interests.

Trading Dev DMCC is the first company we invested in and operates in line with our investment mandate by using:

A leading company in developing advanced software for market analysis and trading, Trading Dev DMCC’s initial investment. With solutions combining cutting-edge technology and market insights, Trading Dev DMCC exemplifies our vision.

Ancova Capital Management oversees the operational and strategic aspects of our investments. With a strong focus on compliance and governance, Ancova ensures seamless fund management, aligning with DFI Capital’s vision and goals.

Nav Consulting provides precise fund accounting, reporting, and administrative support. Their expertise ensures transparency and accuracy, essential for managing and monitoring our investments effectively.

FinCode FZCO acts as our strategic advisor, offering insights and recommendations on financial technologies.

Their expertise supports informed decision-making, driving innovation in our portfolio.

$50.000,00

DFI Capital SP

50% of fund profits

Monthly

KYG0428M1327

G0428M 132

NAV Fund Administration

Carey Olsen

Are you a potential investor looking to join our journey of innovation and growth? Or an ambitious company seeking strategic funding and expertise? Reach out to DFI Capital to explore how we can collaborate. Together, we can drive impactful change in financial markets through innovative solutions.

Investing in DFI Capital SP involves substantial risks, including the potential loss of all or part of your investment. The fund operates under Ancova Capital Management SPC, a Cayman Islands-regulated entity, and is not insured by any government or private institution. Investments are subject to market volatility, liquidity constraints, leverage amplification, and algorithmic trading risks, including potential errors or unforeseen market conditions. Additionally, forex trading and reliance on Trading Dev DMCC, the fund’s primary portfolio company, concentrate risk and heighten exposure to operational and counterparty risks. While dividends are anticipated based on trading profits, they are not guaranteed. Ancova Capital Management SPC assumes no liability for investment outcomes, as all investment decisions are made by the appointed investment advisor, Fincode FZCO, which identifies and invests in unique privately owned firms globally. Past performance is not indicative of future results, and potential investors are encouraged to seek independent financial advice before committing capital.

The information contained in this website DFI Capital FUND Cayman. The information contained herein has been prepared for discussion purposes only and does not constitute an opinion or appraisal. This website contains or may contain certain statements and forward-looking projections relating to the Fund’s future prospects, developments, and business strategies. The forward-looking statements on this website are based on current expectations and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by those statements.

By accepting to enter this website, the potential investor acknowledges to have been informed and agrees that the investment referred to in the website includes confidential, sensitive and proprietary information and he/she must keep it confidential. Transmission of this information to any other person is unauthorized, except by persons duly entitled to this purpose by the Fund, directly or indirectly. The content of this website has not been approved by any authorized person or authority.